Press Release

Zoomcar Accelerates Profit Momentum in FY25 with Record Contribution and 44% EBITDA Improvement

June 30, 2025

5 Min Read

Host Quality, Repeat Usage, and Cost Optimization Drive Turnaround; Contribution Profit Hits

$4.25M, Operating Loss Cut by 67%

Bangalore, India – June 30, 2025 – Zoomcar Holdings, Inc. (OTCQX: ZCAR) (“Zoomcar” or “the Company”), India’s leading car-sharing marketplace, today announced financial results for its fiscal year ended March 31, 2025.

“FY 2025 was a pivotal year for Zoomcar as we strengthened our marketplace fundamentals and achieved new financial milestones. We continued to see meaningful improvements in Guest repeat behavior and Host retention; core elements that drive scale and sustainability. With a record contribution profit and a sixth consecutive profitable quarter on a contribution basis, we believe we’re moving firmly in the right direction. We remain focused on improving the customer experience and leveraging technology to unlock greater value for our Guests and Hosts.”

1. ContributionProfit Reaches All-Time High

Zoomcar reported a record contribution profit of $4.25 million (47% of revenue) for FY25, compared to a loss of $(0.98) million (-10% of revenue) in FY24. Contribution profit per booking increased to $9.96, up from $(2.52) in the previous fiscal year. This marks the sixth consecutive quarter of positive contribution profit.

2. Sustained Growth in Bookings and Repeat Users

Bookings grew 10% YoY, from 387,821 in FY24 to 426,788 in FY25. Our repeat user rate increased by 86% (13% in FY25 as compared to 7% in FY24), driven by product enhancements and loyalty initiatives.

Cost of Revenue reduced by 49%, from $10.33 million in FY24 to $5.30 million in FY25, supported by operational efficiencies and dynamic pricing . Marketing spend declined 75%, alongside a 43% reduction in G&A and 32% decrease in technology related expenses.

Total costs and expenses decreased from $41.57 million in FY24 to $19.51 million in FY25. These savings directly supported improved unit economics and reduced cash burn.

Average Guest trip rating rose to 4.70, up from 4.16 in the prior year. High-quality cars (rated 4.5+)

increased by 58% (49% in FY25 as compared to 31% in FY24).

Adjusted EBITDA loss improved by 44%, from $(17.85) million to $(9.91) million. Loss from operations narrowed significantly by 205%, from $(31.67) million in FY24 to $(10.40) million in FY25.

Zoomcar launched advanced vehicle inspection and GPS safety protocols in partnership with a leading ecosystem player to enhance quality and transparency across host vehicles. We are also rolling out in the next quarter, new B2B tools to help fleet operators seamlessly manage and scale their inventory on the platform. Early adoption of AI-led support and fraud detection has improved platform efficiency and guest trust, laying a strong foundation for Zoomcar’s next phase of tech- driven, high-quality growth.

Zoomcar will host its FY24-25 earnings call on Monday, June 30, 2025, at 8:00 AM ET / 5:30 PM IST. Please register here: https://us06web.zoom.us/webinar/register/WN_gCU972PFSBmRtLaDcqpjGw#/registration For more information, including the full investor deck and filings, please visit: https://investor- relations.zoomcar.com/in/

Founded in 2013 and headquartered in Bengaluru, Zoomcar is India’s largest peer-to-peer car- sharing marketplace. Through its digital-first platform, Zoomcar connects individual vehicle owners (Hosts) with users (Guests), offering flexible access to vehicles for self-drive rentals. The company’s mission is to promote smarter, shared mobility that is both economically empowering and environmentally sustainable.

Certain statements contained in this press release are not historical facts and may be forward- looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “plans,” “expects,” “believes,” “anticipates,” and similar words are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements concerning our expected revenue growth and improved profitability, and our financial forecasts. Forward-looking statements are based on our current expectations and beliefs,

and involve a number of risks and uncertainties that are difficult to predict and that could cause actual results to differ materially from those stated or implied by the forward-looking statements. A description of certain of these risks, uncertainties and other matters can be found in filings we make with the U.S. Securities and Exchange Commission, all of which are available at www.sec.gov. Because forward-looking statements involve risks and uncertainties, actual results and events may differ materially from results and events currently expected by us, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update these forward-looking statements to reflect events or circumstances that occur after the date hereof or to reflect any change in its expectations with regard to these forward-looking statements or the occurrence of unanticipated events.

To supplement our financial statements, which are presented on the basis of U.S. generally accepted accounting principles (GAAP), the following non-GAAP measures of financial performance are included in this release: contribution margin, and adjusted EBITDA. A reconciliation of GAAP to adjusted non-GAAP financial measures is included as an attachment to this press release. We believe these non-GAAP financial measures are useful to investors in assessing our operating performance. We use these financial measures internally to evaluate our operating performance and for planning and forecasting of future periods. We also believe it is in the best interests of investors to provide this non-GAAP information. While we believe these non-GAAP financial measures provide useful supplemental information to investors, there are limitations associated with the use of these non-GAAP financial measures. These non-GAAP financial measures may not be reported by competitors, and they may not be directly comparable to similarly titled measures of other companies due to differences in calculation methodologies. The non- GAAP financial measures are not an alternative to GAAP information and are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures.

They should be used only as a supplement to GAAP information and should be considered only in conjunction with our consolidated financial statements prepared in accordance with GAAP.

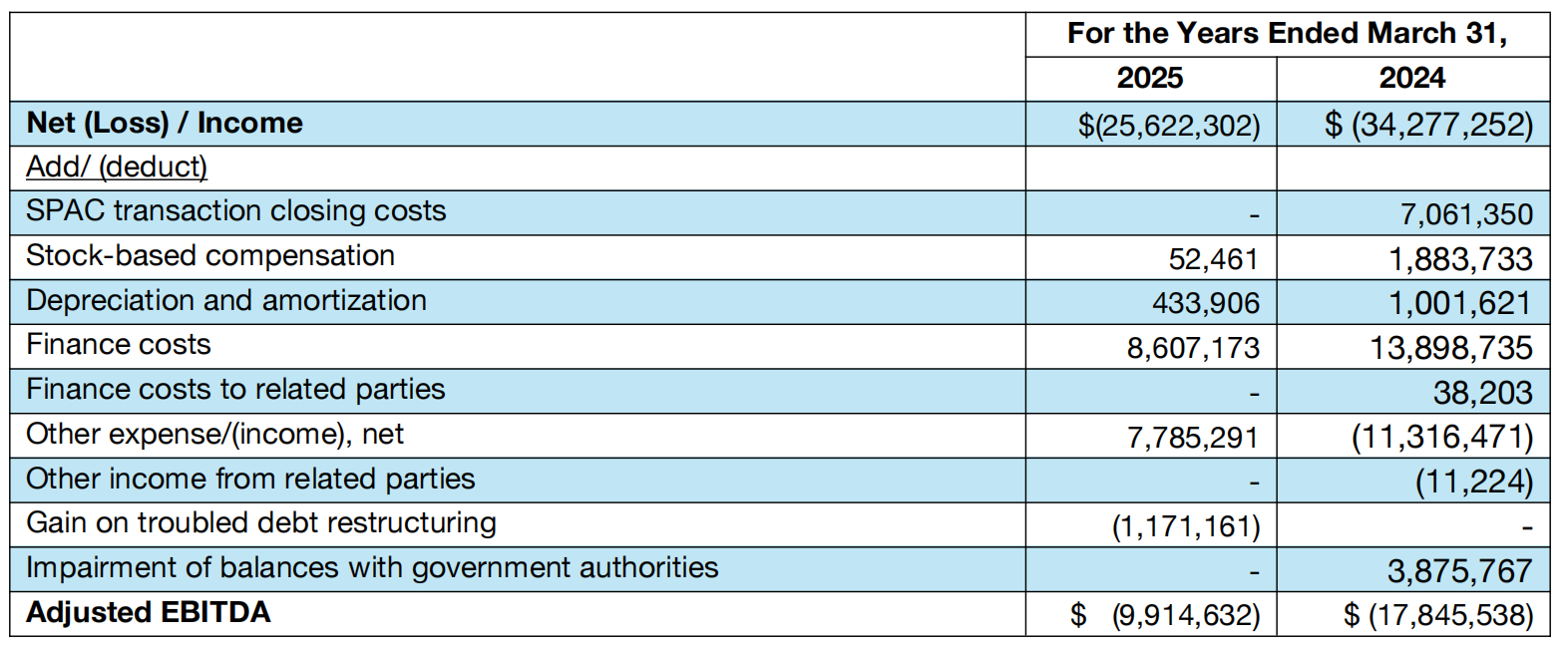

The following is the reconciliation of adjusted EBITDA to the most comparable GAAP measure for the year ending March 31, 2025 as compared to March 31, 2024.

Adjusted EBITDA is a non-GAAP financial measure that represents our net income or loss adjusted for (i) Exceptional non-recurring expenses (ii) stock-based compensation expense,(iii) depreciation and amortization (iv) finance costs, (v) Gain on troubled debt restructuring and (vi) Other income/Expense.

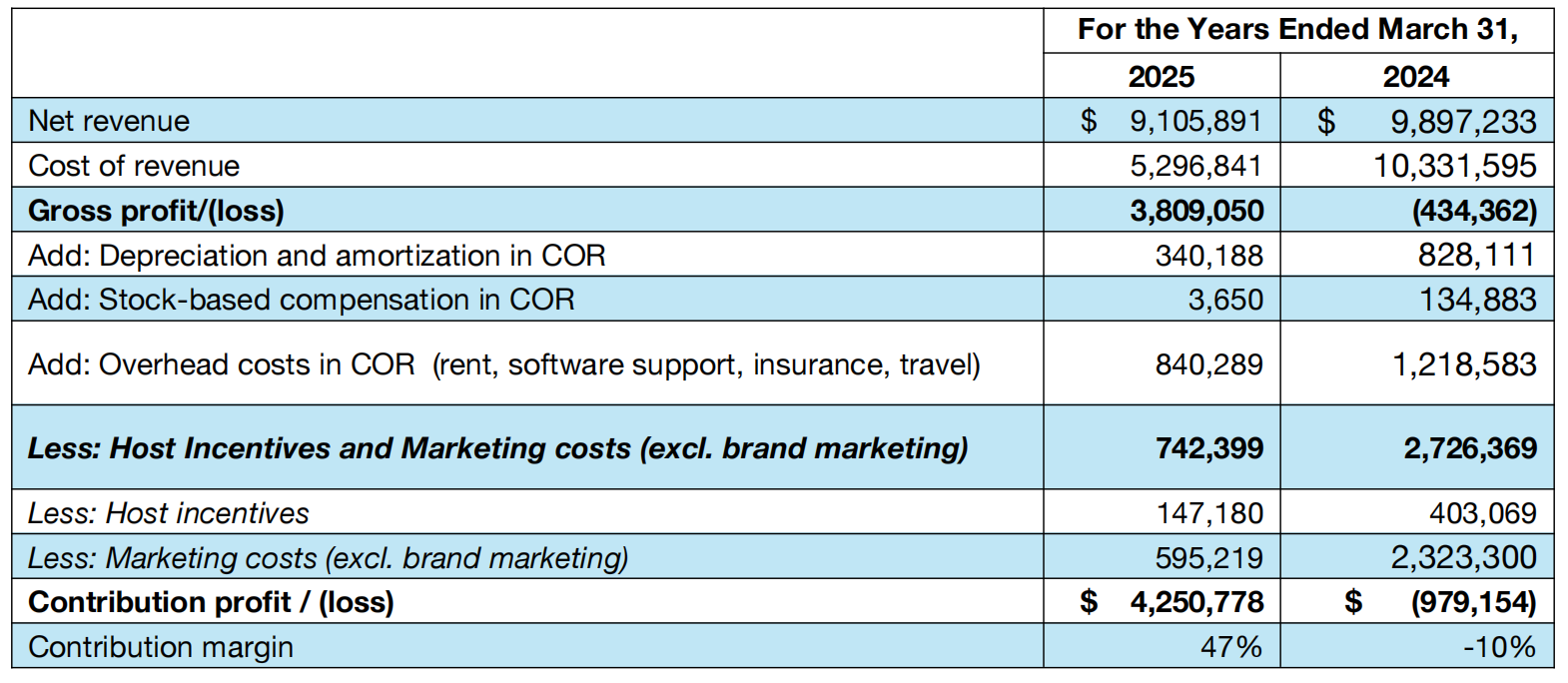

The following is the calculation of Contribution Profit/(Loss) to the most comparable GAAP measure for the year ending March 31 2025 as compared to March 31, 2024.

We define contribution profit (loss) as our gross profit/(loss) plus (a) depreciation expense included in cost of revenue, (b) stock-based compensation expense included in cost of revenue, (c) other general costs included in cost of revenue (rent, software support, insurance, travel); less (i) Host incentive payments and (ii) marketing and promotional expenses (excluding brand marketing).

Contact: investors@zoomcar.com press@zoomcar.com

©2026 Zoomcar Terms Privacy Cookie preferences